Anúncios

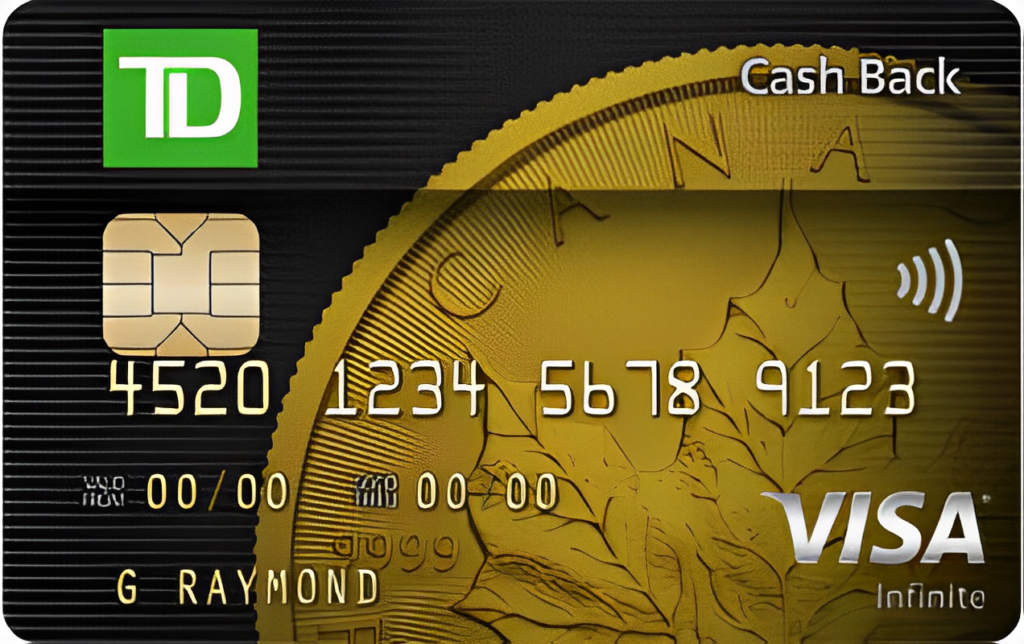

If you are looking for a gas card with cash back on essential purchases, the TD Cash Back Visa Infinite has 1% cashback. Pre-authorized recurring accounts are also at 3%. For those who like to travel frequently, but generally not at the same level as a regular traveller, the TD – Cash Back Visa Infinite credit card offers the extra flexibility they need.

They are specifically designed for regular travelers, with a variety of benefits and savings. It is one of the best cashback cards available in Canada. Offers a generous welcome offer including 3 months 10% cash back on all purchases and other useful benefits such as travel, discounts and rewards.

Anúncios

Pros

Earn cash rewards with your favorite retailer. Use them to redeem cash back whenever you want. Receive emergency medical insurance and other travel benefits as valuable benefits that you can use at any time.

Cons

You may not receive “cash rewards“, but you can start with a low APR credit card or transfer unspent funds to your statement balance.

Anúncios

Highlights TD – Cash Back Visa Infinite

Get up to $2,000 cash back in your first month. Once you hit your first $2,000 discount, all other purchases earn 6% cash back for the remainder of your billing cycle.

No annual fee for the first year. Get 3% cash back on pre-authorized purchases, gas and bill payments and 1% cash back on everything else. Spending Limit: $15,000 in the 3% category and no spending limit on the 1% refund.

You can buy more flights and redeem more reward points. Now with a flexible refund program. Make sure you save $25 to redeem early and get a minimum 10% discount off our Canadian and US car rental rates, or just use it to pre-purchase your trip so you can get a minimal discount 5% at home.

Up to $2 million in 10-day travel medical insurance. Or you can get it on your day trip and enjoy unlimited drinks throughout the day for just $2. Rent collision and car loss damage insurance for up to 50% more stars at participating Starbucks stores!

The free Elite TD Auto Club membership comes with the Visa Infinite Concierge service, which is provided 24/7. The club package allows you to enjoy unlimited features and services that are beneficial for car owners.

The Visa Infinite luxury hotel collection is simply exquisite and offers access to many benefits, including a range of additional luxury experiences with Visa Infinite Experience Credits.

Conclusion TD – Cash Back Visa Infinite

We are always working to find new ways to thank our customers and the TD Cash Back Visa Infinite card is one of those ways. There’s a 3% cashback discount on all grocery, gas, and recurring bills purchases, but if you’re looking for more rewards, we also have a 1% cashback on all other purchases!

This credit card offers travel perks and other premium benefits including a TD Auto Club membership, warranty protection and extra stars in your Starbucks Rewards app. The earning potential alone is a great selling point too.

Income requirements

The credit card requires a minimum annual income of $60,000 for an individual or $100,000 for a family.

How to Apply for the TD Cash Back Visa Infinite Card

The process of applying for the Card is quite simple: Follow the instructions on the TD Bank website to initiate the online application. Enter your province of residence to get a personalized credit card and click Apply Now.

To review the terms and conditions and use this card, click ‘I Agree’ in the card agreement. You need to enter these details: Your name, date of birth, telephone number, email address and home address.

At TD Bank, we want you to be fully informed about your finances and status. To do this, please tell us about your current employment status, annual personal income (including spouse’s income), family income and residential status.

Adding a cardholder? Add your personal information and review insurance coverage and card terms and conditions. Submit your application.

You will be redirected

Did you like this article?

Credit cards can be used in many ways. In today’s crowded marketplace, finding the right credit card can be difficult. Here are some tips that will help you get the most out of your card.