Anúncios

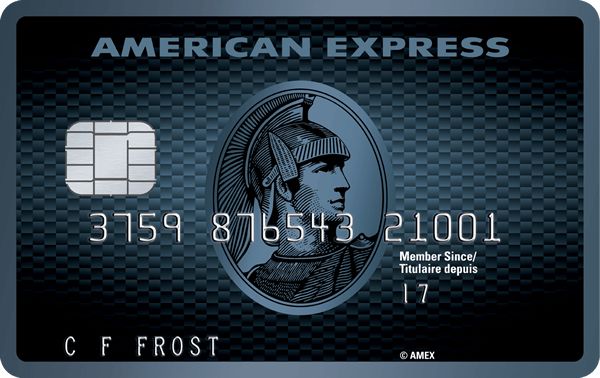

Find out the american Express Cbalt credit card and its features. Create points by participating in, doing and owning your favorite things. Earn up to 30,000 points! As a new Cobalt Cardmember, you can earn 2,500 points every month you spend $500 or more on your card. This could add up to 30,000 points by the end of your first year with us.

The American Express Cobalt Card is a great way for Canadian residents to enjoy rewards and travel points benefits. To obtain one, however, you must be able to answer ‘yes’ to certain prerequisites. This includes being a resident of Canada and having an annual income of at least $12,000.

Anúncios

American Express Cobalt Features

First, toy can get extra cards at no extra fees, that way you will not pay a annual fee. Live your life the way you want to be rewarded. Earn points for activities you enjoy and get exclusive Perks designed just for you – all from a rewards program that’s tailored to your lifestyle.

Mobile Device Insurance provided by Amex group protects your phone so you can use it with more assurance. Transfer points 1:1 to all the rewards programs you could ever dream of. Get access to rewards with Membership Rewards points: you can redeem on gift cards, shopping on Amazon.ca and much more. Points have never been this powerful before!

Anúncios

How earn points

5X POINTS: On food and drink purchases at eligible restaurants or cupcake shops, as well as delivery from clear favourites in Canada. 3X POINTS: Get 3 times the points for eligible streaming subscriptions in Canada. 2X Points. You can get them on transit and on eligible travel coming up soon. 1X POINTS: As you shop online for anything

Earn 1 additional Membership Rewards point for every $1 you charge to your Cobalt Card on hotel and car rentals booked through American Express Travel. As a Basic Cardmember, you’ll be able to refer friends and earn 75,000 Membership Rewards points per approved referral to reach the maximum annual bonus of $750

How Redeem you Cobalt points

Signing up for the cobalt card from american express allows you to use your points towards a variety of purchases that you can select from. Your options are practically endless: streaming subscriptions, theatres tickets, food & drinks and much more.

You can transfer Membership Rewards points 1:1 to various frequent flyer and other loyalty programs of your choice. Check them out here. You’ll also be able to redeem points for a variety of rewards!

Things like travel on American Express Travel Online, Gift cards and merchandise through membershiprewards.ca, purchases at Amazon.ca, and flights through Fixed Point Travel Program. If you’re a Cobalt cardmember, you’ll find there are lots of Perks to enjoy. Bonus rewards, free tickets to events and more – it’s all yours when you have a Cobalt Card.

How to Apply for an American Express Cobalt Card

To get the American Express Cobalt Card, you’ll need to answer “yes” to these prerequisites. You’re a Canadian resident. You have a Canadian credit file and you’re of legal age where you live. Wondering how to apply for a credit card? Here are the basics you need to know.

Before you apply, it’s crucial that you consider the impact of your decision: Are you under 21, unemployed or do not have an active SSN? Learn more about the application process and requirements. The credit card account age requirement is a federal law, and it’s unlikely that you’ll be approved for one if you don’t meet these other two requirements.

Things to Know Before You Apply

As long as you have a good credit score, you’re subject to approval. We accept a variety of different rates for different types of credit you may have. If you’re having trouble with payments, that’s okay, as your fees will be affected accordingly, and just so you know, if things don’t improve, the fee applicable to your account could go up to 23.99%.

Please refer to the information box included in this app for the definition of a Missed Payment and what fees apply to charges on your account. There will be a fee charged that is required before your balance can be paid in full. Choosing the right card can be difficult — and applying for a credit card isn’t easy either. This guide can help you start a more informed conversation with your bank.

You will be redirected

Did you like this article?

It can be hard to find the best credit card for you. We’ve done the research and can tell you which one is best considering your needs. Check out our site!